Bingo Raffle

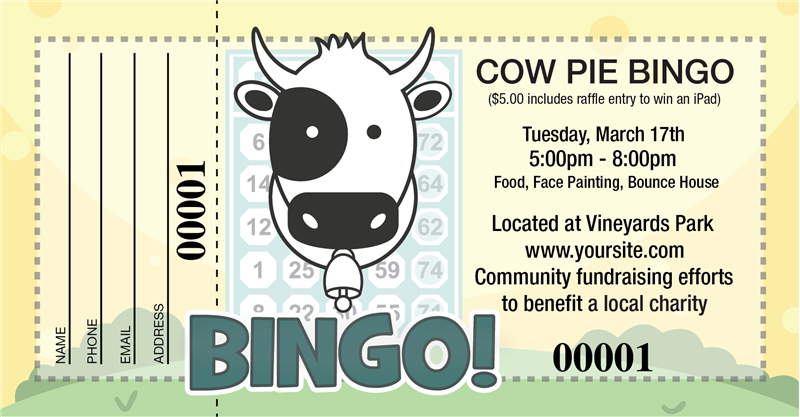

A “raffle” is a form of bingo. Organizations wishing to conduct a raffle must satisfy the following requirements: the organization must have received a tax-exempt determination letter from the Internal Revenue Service stating that it is exempt from federal income taxation under Section 501(c)(3) of the Internal Revenue Code. Conducting of bingo games and raffles is limited to non-profit religious, charitable, fraternal, educational and veterans organizations. The license period for all charitable gaming licenses runs from July 1 through June 30. Bingo Application Fees. Bingo Organization = $25; Bingo Distributor = $500 an additional $1,000 bond is required. Bingo license applications: obtaining, completing, submitting, and renewing licenses Defense proceedings: denied or revoked licenses Unlicensed gaming counsel: compliance for eligible organizations wishing to run raffles or poker festivals without a license. Bingo/Raffle The tax is levied and collected on sales by licensed distributors to authorized organizations that have been in continuous existence for 5 years or more in this state. The 3/10¢ tax is levied on the sale of each bingo face. Alternative methods of conducting raffles (after a license or permit has been obtained) Bucket raffle - APPROVED. Cow-a-bunga (cow bingo) raffle - APPROVED. Duck pond raffle - APPROVED. Duck (rubber) race raffle - APPROVED. Elimination raffle - APPROVED. Flower raffle - APPROVED. Golf ball drop raffle - APPROVED. Heads or tails raffle - APPROVED.

Bingo/Raffle

The tax is levied and collected on sales by licensed distributors to authorized organizations that have been in continuous existence for 5 years or more in this state. The 3/10¢ tax is levied on the sale of each bingo face. In addition to the levied tax, an annual registration process requires permit fees be collected from the following:

- Manufacturers/Distributors - $2,500.00

- Licensed Authorized Organizations:

Annual bingo/raffle permit - $100.00

Temporary bingo permit - $25.00

Class I temporary raffle permit - $25.00

Class II temporary raffle permit (donated prize value less than $5,000) - $10.00

Authorized organization” is defined as a nonprofit tax-exempt religious, educational, veterans, fraternal, service, civic, medical, volunteer rescue service, volunteer firefighters organization or volunteer police organization in this state. In addition, a nonprofit tax-exempt instrumentality of the United States Government is a service agency for the purpose of this definition

Applicable statutes: AR Code Ann. §23-114-101 et seq.

DFA Rule(s)

| Title | Posted |

| 2007-4 Charitable Bingo and Raffle | 08/17/2010 |

Forms

| Title | Posted |

| BRR-TEMP Temporary Bingo and Raffle License Renewal | 08/28/2013 |

| ET-391 Bingo Raffle Volunteer Schedule | 08/25/2010 |

| ET-392 Bingo Raffle Qualifying Expense Schedule | 08/25/2010 |

| ET-393 Bingo Raffle Qualifying Charitable Distribution Schedule | 08/25/2010 |

Instructions

Bingo Raffle Cage

| Title | Posted |

| ET-389 Bingo Net Receipts Formula and Allowable Expense Instructions | 08/25/2010 |

| ET-397 Bingo Raffle FAQs | 08/25/2010 |

| ET-399 Bingo Raffle Distributors | 09/19/2019 |

Statistics

Bingo Raffle License

| Title | Posted |

| Bingo Raffle Revenue FYE 2007 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2008 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2009 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2010 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2011 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2012 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2013 | 08/08/2013 |

| Bingo Raffle Revenue FYE 2014 | 07/15/2014 |

| Bingo Raffle Revenue FYE 2015 | 07/14/2015 |

| Bingo Raffle Revenue FYE 2016 | 08/04/2016 |

| Bingo Raffle Revenue FYE 2017 | 07/03/2017 |

| Bingo Raffle Revenue FYE 2018 | 07/03/2018 |

| Bingo Raffle Revenue FYE 2019 | 07/05/2019 |

| Bingo Raffle Revenue FYE 2020 | 07/02/2020 |

| Bingo Raffle Revenue FYE 2021 | 03/02/2021 |